Essential Stock Market Jargon Every Investor in India Should Know

Navigating the stock market can be daunting, especially with the myriad of terms and jargon used by traders and investors. Whether you’re a seasoned investor or just starting, understanding these terms is crucial for making informed decisions. Here’s a comprehensive guide to the essential stock market jargon relevant to the Indian market.

1. Bull Market and Bear Market

- Bull Market: A period where stock prices are rising or expected to rise. It signifies investor confidence and optimism.

- Bear Market: A period of declining stock prices, typically defined as a drop of 20% or more from recent highs. It reflects pessimism among investors.

2. Indices

- Sensex: The Bombay Stock Exchange (BSE) Sensitive Index, consisting of 30 well-established and financially sound companies listed on the BSE.

- Nifty 50: The National Stock Exchange (NSE) Nifty 50 is an index comprising 50 diversified stocks, representing various sectors of the economy.

3. Market Capitalization

- Market Cap: The total market value of a company’s outstanding shares, calculated by multiplying the stock price by the total number of shares. Companies are categorized as:

- Large Cap: Typically companies with a market cap over ₹20,000 crores.

- Mid Cap: Companies with a market cap between ₹5,000 to ₹20,000 crores.

- Small Cap: Companies with a market cap below ₹5,000 crores.

4. Liquidity

- Liquidity: Refers to how easily an asset can be converted into cash without affecting its market price. High liquidity means quicker buying/selling of stocks.

5. IPO (Initial Public Offering)

- IPO: The process through which a private company offers its shares to the public for the first time. This is a way for companies to raise capital for growth and expansion.

6. Dividends

- Dividend: A portion of a company’s earnings distributed to shareholders, usually paid quarterly or annually. Dividends are a way for investors to earn a return on their investment, in addition to any capital gains.

7. Portfolio

- Portfolio: A collection of financial assets, such as stocks, bonds, and mutual funds, owned by an investor. A well-diversified portfolio helps manage risk.

8. P/E Ratio (Price-to-Earnings Ratio)

- P/E Ratio: A valuation metric calculated by dividing the current share price by the earnings per share (EPS). It helps investors gauge whether a stock is overvalued or undervalued compared to its earnings.

9. Market Order vs. Limit Order

- Market Order: An order to buy or sell a stock immediately at the current market price. It ensures execution but doesn’t guarantee the price.

- Limit Order: An order to buy or sell a stock at a specified price or better. It provides price control but may not execute if the price isn’t reached.

10. Circuit Breakers

- Circuit Breakers: Mechanisms to temporarily halt trading on an exchange to prevent excessive market volatility. In India, trading is suspended when indices hit certain thresholds.

11. F&O (Futures and Options)

- Futures: Contracts to buy or sell an asset at a predetermined price at a specified time in the future.

- Options: Contracts that give the holder the right (but not the obligation) to buy or sell an asset at a specific price before a certain date.

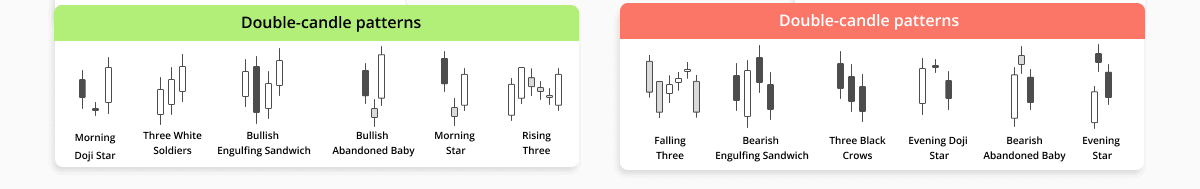

12. Technical Analysis vs. Fundamental Analysis

- Technical Analysis: The study of past market data, primarily price and volume, to forecast future price movements.

- Fundamental Analysis: Evaluating a company’s financial health and intrinsic value by analyzing financial statements, market position, and economic factors.

13. Arbitrage

- Arbitrage: The practice of taking advantage of price differences in different markets to make a profit. For example, buying a stock on one exchange where it’s priced lower and selling it on another where the price is higher.

14. KYC (Know Your Customer)

- KYC: A mandatory process to verify the identity of investors. It involves submitting identification documents to ensure compliance with regulations and prevent fraud.

15. SEBI (Securities and Exchange Board of India)

- SEBI: The regulatory body for the securities market in India, responsible for protecting investor interests, promoting fair practices, and regulating the securities industry.

Conclusion

Understanding these essential stock market terms is crucial for anyone looking to invest in India. Familiarity with this jargon will not only enhance your trading experience but also empower you to make informed investment decisions. As you delve deeper into the world of stocks, remember that continuous learning is key to navigating this dynamic landscape successfully. Happy investing!